Calculate computer depreciation tax

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. For instance a widget-making machine is said to depreciate.

Method To Get Straight Line Depreciation Formula Bench Accounting

This means the van depreciates at a rate of.

. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Where the cost is more than 300 then the depreciation.

It provides a couple different methods of depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

D i C R i. 264 hours 52 cents 13728. 35000 - 10000 5 5000.

The tool includes updates to. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. You can take a deduction for depreciation of 800 each year on your business tax return.

C is the original purchase price or basis of an asset. The MACRS Depreciation Calculator uses the following basic formula. By using the formula for the straight-line method the annual depreciation is calculated as.

Where Di is the depreciation in year i. The average computer lasts 10 years so it decreases in value by 10 each year. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS.

Understanding computer depreciation. Now that you know how to calculate your business portion the real fun can begin. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

Before you use this tool. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë. Normally computers are capitalized and depreciated.

First one can choose the straight line method of.

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Different Methods Of Depreciation Calculation Sap Blogs

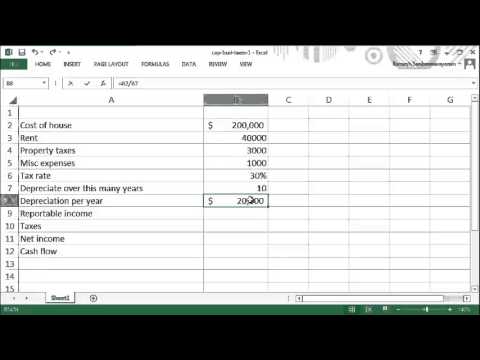

Compute Cash Flow After Depreciation And Tax Youtube

Straight Line Depreciation Formula Guide To Calculate Depreciation

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Calculate Npv Using Excel Model Depreciation After Tax Cash Flow And Net Working Capital Youtube

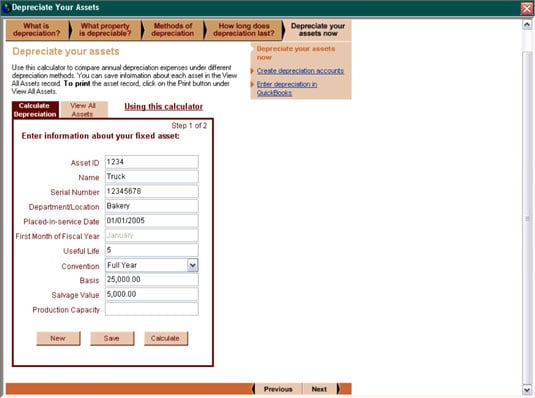

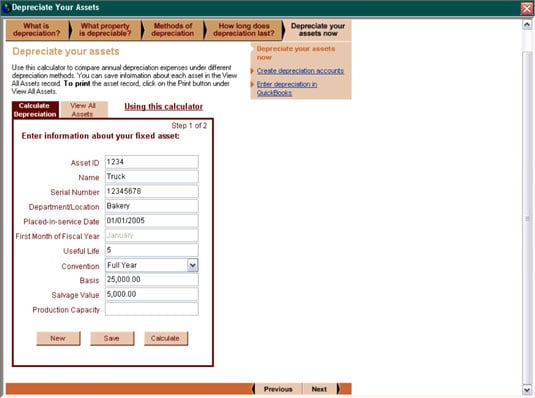

How To Use Quickbooks To Calculate Depreciation Dummies

How To Calculate Depreciation

Using Spreadsheets For Finance How To Calculate Depreciation

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Depreciation Expense

How To Prepare Depreciation Schedule In Excel Youtube

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Establishing The Correct Cost Basis When Calculating Depreciation Depreciation Guru